Whose Tax Burden Hurts More?

Some interesting discussion at instapundit and Mudville about the "are you a liberal quiz."

I thought I'd take on one item. "Simplify and increase the progressivity of the tax code"... I'd certainly agree with simplifying it, but increasing the progressivity? Ouch. How much more can we hammer people who make more money? Hopefully, one day I'll be making some heavy duty earnings - and I think I'd like to keep them. Maybe hire a few more people and make more money.

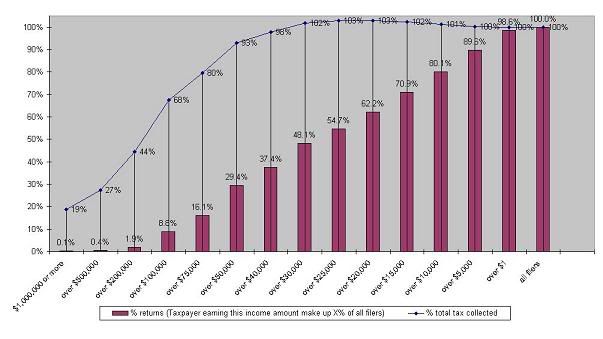

Anyway according to the Congressional Joint Economic Committee, we are already highly progressive. I think they could have illustrated their data a little better. Here's my take on it, using data from the Congressional Report

.1%... that's zero point one percent of all taxpayers pay 19% of all federal income tax. Those are the rich people making over $1 million a year. It's 181,000 tax returns. Think about that, 181,000 families - pay 19% of ALL Federal Income tax. Now I don't make a million dollars a year, probably never will. But it get's worse... 29.4% of filers pay 93% of all federal income taxes. How much do you have to make before you join these ranks? $50,000 a year. That's right, 29.4% of American families make over $50,000 a year. And they pay 93% of all Federal taxes. How much more progressive can we get?

Now you'll notice that on the lower side of the scale, that "taxes paid" goes above 100%. That's because the system takes in more taxes than it keeps. People at the low end of the scale get back more than is paid in. Again... how could this be any more progressive? I don't know, but I'm sure it would be ugly.

Put this into context with the recent news reports about tax cuts "benefitting the rich." The class warfare numbers I remember tossed out were that the top 2% of taxpayers would benefit the most. Sounds bad, until you realize that the top 2% of taxpayers pay 44% of the taxes. Hmmm.

Some interesting discussion at instapundit and Mudville about the "are you a liberal quiz."

I thought I'd take on one item. "Simplify and increase the progressivity of the tax code"... I'd certainly agree with simplifying it, but increasing the progressivity? Ouch. How much more can we hammer people who make more money? Hopefully, one day I'll be making some heavy duty earnings - and I think I'd like to keep them. Maybe hire a few more people and make more money.

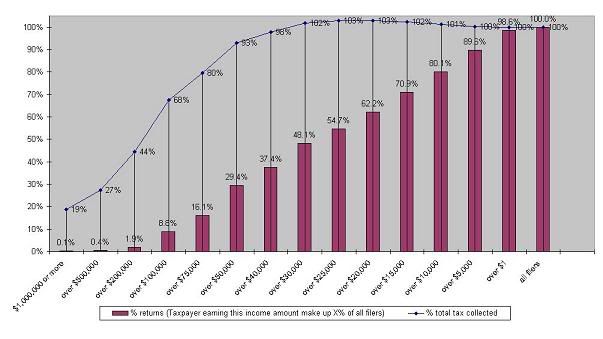

Anyway according to the Congressional Joint Economic Committee, we are already highly progressive. I think they could have illustrated their data a little better. Here's my take on it, using data from the Congressional Report

.1%... that's zero point one percent of all taxpayers pay 19% of all federal income tax. Those are the rich people making over $1 million a year. It's 181,000 tax returns. Think about that, 181,000 families - pay 19% of ALL Federal Income tax. Now I don't make a million dollars a year, probably never will. But it get's worse... 29.4% of filers pay 93% of all federal income taxes. How much do you have to make before you join these ranks? $50,000 a year. That's right, 29.4% of American families make over $50,000 a year. And they pay 93% of all Federal taxes. How much more progressive can we get?

Now you'll notice that on the lower side of the scale, that "taxes paid" goes above 100%. That's because the system takes in more taxes than it keeps. People at the low end of the scale get back more than is paid in. Again... how could this be any more progressive? I don't know, but I'm sure it would be ugly.

Put this into context with the recent news reports about tax cuts "benefitting the rich." The class warfare numbers I remember tossed out were that the top 2% of taxpayers would benefit the most. Sounds bad, until you realize that the top 2% of taxpayers pay 44% of the taxes. Hmmm.

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home